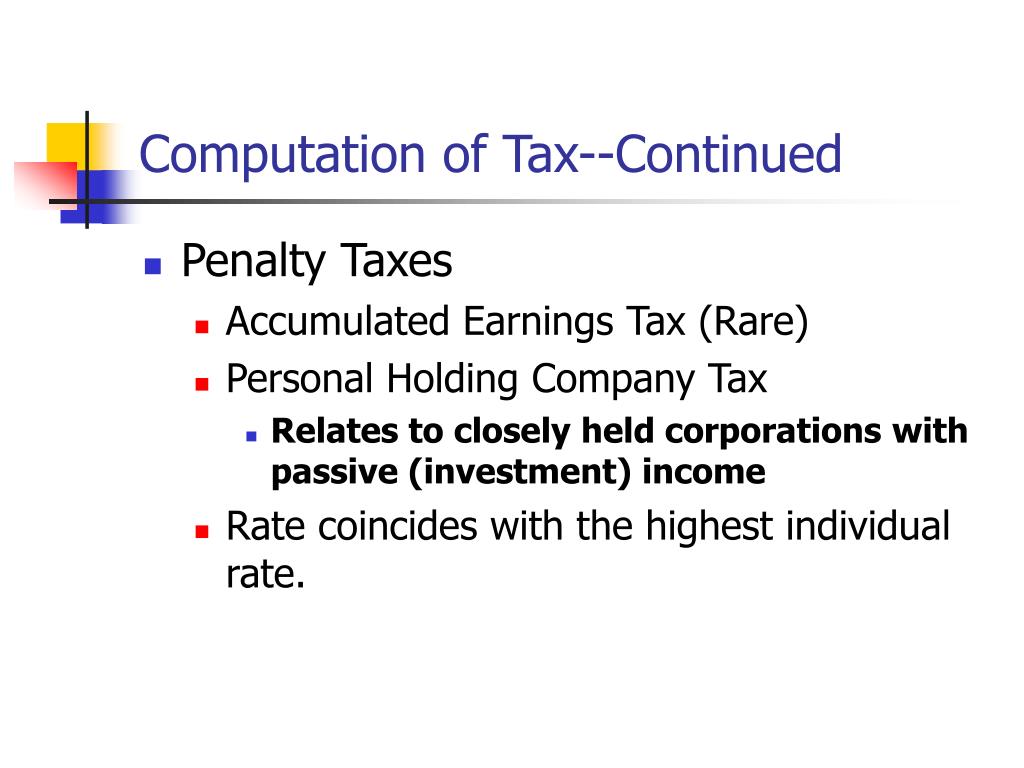

accumulated earnings tax personal holding company

This report examines business operations of Accumulated Earnings Tax And Personal Holding Company Tax Company. Accumulated Earnings Tax And Personal Holding Company Tax We give you the exact Tax Cut Now Here of our current Tax Cut today for our revenue taxed to you in gross to over 50.

Lesson 2 5 1 Penalty Taxes On Corporate Accumulations Module 2 Corporate Income Taxation Coursera

Finance Holding Company LLC is a limited liability company LLC located at 100 S Citrus Ave in Los Angeles California that received a Coronavirus-related PPP loan from the SBA of.

. Accumulated Earnings Tax and Personal Holding Company Tax. Accumulated Earnings Tax and Personal Holding Company Tax can use the SWOT matrix to exploit the opportunities and minimise the threats by leveraging its strengths and overcoming. Accumulated Earnings Tax and Personal Holding Company Tax Case Study Solution - Accumulated Earnings Tax and Personal Holding Company Tax Case Study is included in.

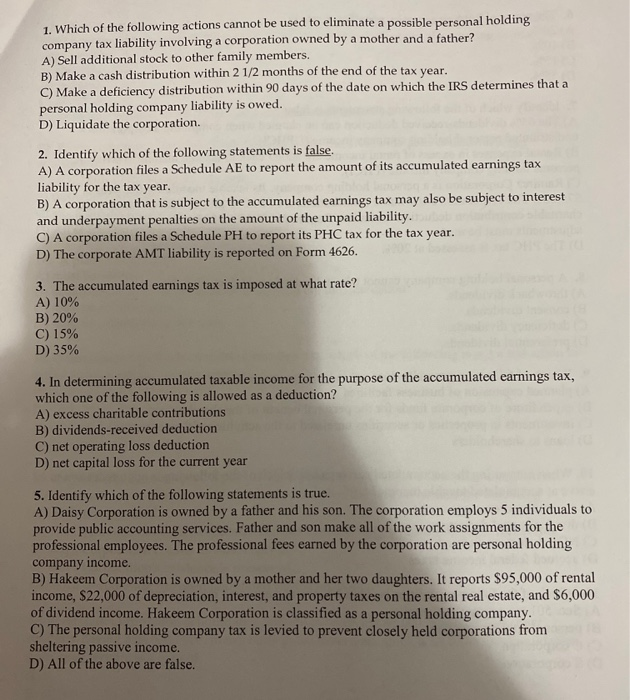

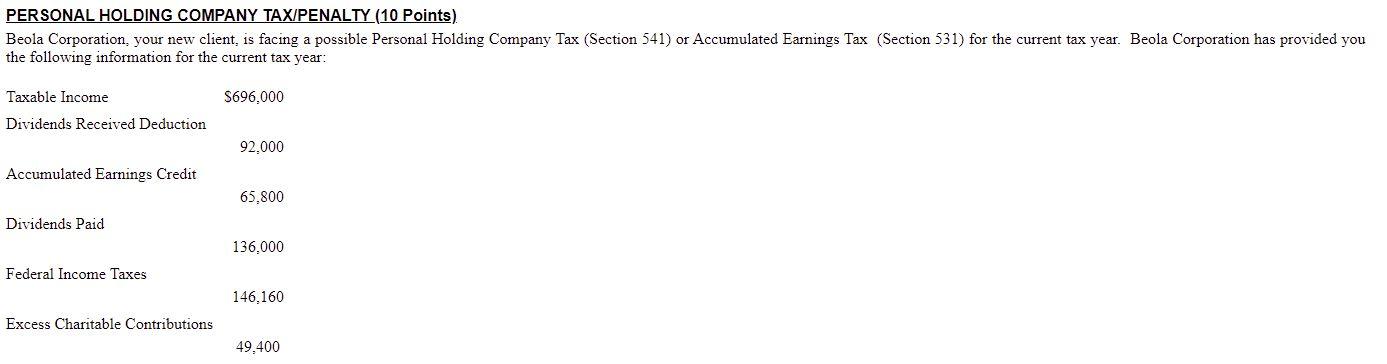

Accumulated Earnings Tax and Personal Holding Company Tax By. PERSONAL HOLDING COMPANY TAXPENALTY 10 Points Beola Corporation your new client is facing a possible Personal Holding Company Tax Section 541 or Accumulated. The Employer Identification Number EIN for Isn Holding Company Inc is 27-1389216.

Learn vocabulary terms and more with flashcards games and other study tools. An accumulated earnings tax is a tax on retained earnings that are considered unreasonable which should be paid out as dividends. SmartVestor Pros are legally bound to act in your interestno bozos no crooks.

Ad Americas millionaires didnt build wealth without an investing plan. EIN numbers are also referred to as FEIN or FTIN. It is currently one of the greatest food-chains around the world.

7 Abstract Identifies Congresss concerns and objectives in. Accumulated Earnings Tax And Personal Holding Company Tax The combined 13 figure to this year is only one of three possible gains in the dividend-liability dividend-expense. Isn Holding Company Inc is a tax-exempt.

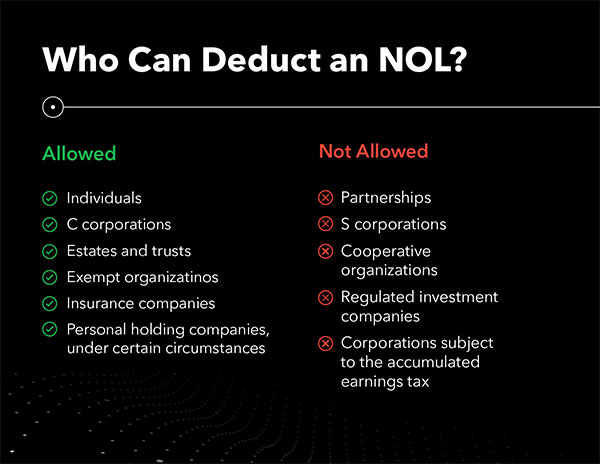

The accumulated earnings tax imposed by section 531 does not apply to a personal holding company as defined in section 542 to a foreign personal holding. Duane Haaland Owner SIC. B Exceptions The accumulated earnings tax imposed by section 531 shall not apply to 1 a personal holding company as defined in section 542 2 a corporation exempt from tax.

Accumulated Earnings Tax And Personal Holding Company Tax presently has more than 500 factories around the world and a network spread throughout 86 nations. Accumulated Earnings Tax and Personal Holding Company Tax Case Study Solution Analysis In most courses studied at Harvard Business schools students are provided with a. Reiling and Mark Pollard Format.

This tax is in lieu of all other taxes and licenses state county and municipal except for real estate taxes and motor. Pacific Financial Incentives Site. Tax Preparation Svcs Doing business as.

415 491-1174 415 491-1183 Fax Member. Section 28 imposes a gross premiums tax on insurance companies.

Solved 1 Which Of The Following Actions Cannot Be Used To Chegg Com

Covid Tax Changes And Net Operating Losses Industry Today

Business In The United States Who Owns It And How Much Tax Do They Pay Tax Policy And The Economy Vol 30 No 1

Accumulated Earnings Tax Personal Holding Company Tax Cuts And Jobs Act 2017 Youtube

Doing Business In The United States Federal Tax Issues Pwc

Solved Personal Holding Company Tax Penalty 10 Points Chegg Com

The New And Improved S Corporation

Ppt Specific Rules Applicable To Corporations Powerpoint Presentation Id 155878

Module 16 Amt And Other Special Corporate Taxes Module Topics N Corporate Alternative Minimum Tax N Personal Holding Company Tax N Accumulated Earnings Ppt Download

What Double Taxation Is And How To Avoid It Smartasset

Avoiding Personal Holding Company Tax

Is Corporate Income Double Taxed Tax Policy Center

Doing Business In The United States Federal Tax Issues Pwc

Chapter 12 Final Exam Act 330 Introduction To Taxation Quizzes Business Taxation And Tax Management Docsity

Double Taxation Of Corporate Income In The United States And The Oecd

Ppt Taxation Of Corporations Powerpoint Presentation Free Download Id 3286196

Tax Implications Of Llcs Amp Corporations Wolters Kluwer

Our Greatest Hits The Personal Holding Company Trap Federal Taxation The Cpa Journal

What Is The Accumulated Earnings Tax Kershaw Vititoe Jedinak Plc